Hello, everyone! Welcome to this week’s edition of Shattering Illusions. This week, we cover “The Evil of Retirement in the Age of AI.” I’m not saying retirement is evil, but that it can be “an” evil - that is, it can be a bad thing for people. But many people still want it.

That’s where the Parable of the Rich Fool can help us dispel our illusions regarding what retirement is in our society vs. what it’s portrayed to be, and we can better understand how AI may change the future of retirement. Our current view of retirement (at least in the United States) is eerily similar to the aspirations of the Rich Fool, which should cause us to pause and reflect.

Here is an AI-transcribed outline summary (which I’ve looked over and modified) of this week’s podcast about retirement in the age of AI from a Christian worldview, structured around the Parable of the Rich Fool from Luke 12:13–21.

1. Core Message:

“One’s life is not in the abundance of his possessions,” (Luke 12:15, Christian Standard Bible).

This Biblical idea challenges the modern notion of accumulating wealth for extended personal ease and fulfillment.

2. The Parable of the Rich Fool:

A man stores up wealth for future ease but dies before enjoying it.

His mistake: accumulating for himself without being “rich toward God” (i.e., without loving God and neighbor).

Lesson: Preparing for a self-centered future that may never come is foolish and spiritually dangerous.

3. Historical Context of Retirement:

Ancient Models:

Hinduism: Sannyasa stage of life for spiritual focus, often for the elderly.

Rome: Pensions to prevent political rebellion from soldiers who had left the military, as well as otium for leisure activities.

Greece: the idea of leisure.

Old Testament: Levites (temple assistants) retired at 50 (Numbers 8).

New Testament: Church support for needy widows over 60 (1 Timothy 5).

Modern Retirement:

Industrialization displaced older workers. Many people in society believed that older workers were not as physically productive as younger workers in factories and so should exit the workforce. However, many of the older workers did not want to quit. Pensions helped support them financially after their exit from the workforce.

Government pension systems emerged as social stabilizers (e.g., Bismarck’s Germany).

Retirement became a solution to age-based unemployability—not a reward for productivity.

Note that there can be other reasons for retirement apart from employer preferences (e.g., people living longer but not in good health, leading to an inability to do work). But these reasons differ from the original productivity-driven reasons for promoting retirement.

4. AI's Disruption:

Older workers (50+) already face hiring bias.

AI could further marginalize older knowledge workers (e.g., writers, analysts).

Previously, older workers were not seen as physically productive. So they were already not working as much in physical jobs.

However, knowledge work (e.g., work requiring judgment, creativity), particularly those requiring expertise, were seen as a way for older workers to contribute - “the wisdom of the aged” so to speak.

Now, with AI (especially Generative AI such as ChatGPT), older knowledge workers may be at least partially automated, leading to a reduction in their demand in existing jobs.

But - and this is crux of the issue - if older knowledge workers are laid off due to automation, they may well have a difficult time finding a new job. They may need to retrain, which can be helpful, but even then can face difficulty getting hired.

This would lead to involuntary retirement, longer unemployment, and economic insecurity.

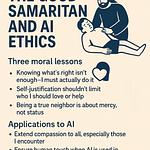

5. Christian Ethical Response:

Wealth should be used for God's purposes, not hoarded for personal comfort.

Christians are called to:

Care for the elderly and needy, especially within families (1 Timothy 5).

Build communities of support, including churches.

Encourage meaningful engagement in old age—spiritual pursuits, service, mentoring.

6. Broader Cultural Critique:

Modern retirement is often about escapism from work and purpose.

It reflects a society that no longer values the elderly for productivity.

The “golden years” ideal is largely a constructed illusion masking deeper societal dysfunctions.

7. Practical Guidance:

See retirement in our society for what it is, not what it is portrayed to be.

Save and invest wisely for retirement (“gather wealth little by little,” Proverbs 13:11), considering that it may well be in your future, even involuntarily.

Consider self-employment, contract work, or (if you have sufficient assets) managing your wealth as a way to keep working even in case of an involuntarily layoff from work after 50.

This doesn’t exclude getting another job after 50 (which is possible), but these are other options.

Cultivate age-independent activities and non-work identities, and start these early in your life. These can carry over into retirement and allow for a happier and more meaningful time if and when one’s career ends.

Engage in service, paid or unpaid. In addition to providing for yourself, have an eye to serving God and others with your wealth.

Further Reading:

If you’re interested in a more detailed history of retirement in the United States, you can check out this article from the National Bureau of Economic Research which I used in researching this podcast episode.

Share this post